Modernizing Demand Forecasting in Manufacturing

What Is Demand Forecasting?

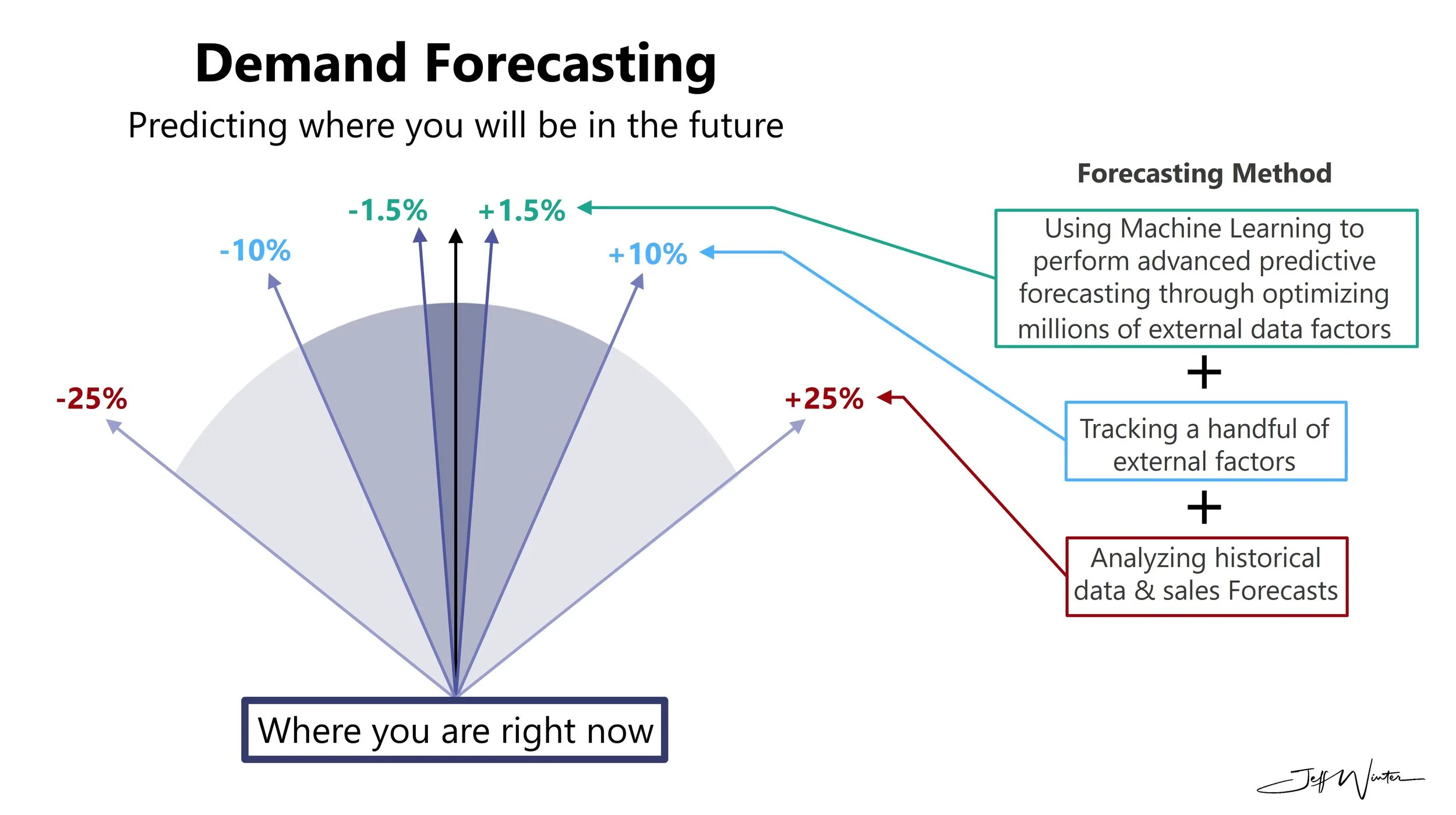

Demand forecasting is the process of predicting future customer demand for products or services over a specific time horizon—typically weeks, months, or quarters. It relies on a combination of historical sales data, market trends, promotions, seasonality, and external signals such as economic indicators or weather patterns to estimate how much of a given product will be needed in the future. The goal is to provide a reliable estimate of “what” and “how much” customers will buy, allowing the business to prepare accordingly. Effective demand forecasting minimizes uncertainty, enabling better inventory control, smoother production planning, and fewer lost sales or overstock scenarios. It's a foundational input that informs nearly every aspect of the supply chain, from procurement and manufacturing to logistics and fulfillment.

How Demand Forecasting Differs from Demand Planning (and Other Forecasts)

While demand forecasting focuses purely on generating an accurate estimate of future demand, demand planning is the broader, cross-functional process of aligning that forecast with supply chain capabilities and business constraints. It includes decisions around production scheduling, inventory stocking, supplier coordination, and distribution—all based on the forecasted numbers. In other words, forecasting produces the “what and how much,” while planning answers “how, when, and where” that demand will be fulfilled.

It's also important to distinguish demand forecasting from other types of forecasting used in manufacturing. Supply forecasting looks at the availability of resources such as raw materials, production capacity, or labor—ensuring the supply side can meet projected demand. Financial forecasting, on the other hand, models revenue, cost, and profit expectations at a business-wide level, often tied to budgeting or investor reporting. While these forecasting types are all interconnected, each serves a distinct purpose. Demand forecasting serves as the cornerstone—setting the pace for both operational readiness and financial expectations by anticipating customer behavior with as much accuracy as possible.

Modern Forecasting Methods:

Manufacturers use a mix of traditional and advanced methods to generate forecasts. Broadly speaking, forecasting techniques fall into quantitative and qualitative categories:

Time-series models: These quantitative methods (e.g. ARIMA, exponential smoothing, moving averages) rely solely on historical sales data to extrapolate future demand. They identify patterns such as trends and seasonality in past demand. Inputs typically include historical volume, calendar/season effects, and product life-cycle stage.

Strengths: well-understood and easy to automate, effective for mature, stable products with strong history.

Weaknesses: they assume future demand patterns mirror the past, so they often fail for volatile products, promotions or one-off events. Use case: establishing a baseline forecast for regular SKUs with long history.

Causal/statistical models: These quantitative methods (such as regression or econometric models) incorporate external drivers and explanatory variables. For example, a causal model might include price, promotions, marketing spend, economic indicators, competitor actions or weather as inputs. By explicitly linking these factors to demand, causal models can scenario-plan “what-if” changes.

Strengths: capture business drivers, useful for understanding the effect of promotions or macro factors.

Weaknesses: they require identifying the right variables and may overfit if there are too many factors. They also assume the relationships (often linear) stay valid. Use case: analyzing the impact of price changes, advertising, or holiday schedules on demand.

Machine Learning / AI approaches: Advanced AI methods (e.g. random forests, gradient boosting, neural networks, and increasingly specialized deep learning architectures) can ingest vast amounts of data – including sales, marketing, promotions, sensor/IoT data, economic signals, social media trends and more. ML models learn complex, non-linear relationships and interactions that classical models miss.

Strengths: high predictive power, ability to capture subtle patterns and adapt to new data; ideal for complex, dynamic environments.

Weaknesses: require large, clean datasets and ML expertise; they can be “black boxes” and may overfit without proper validation. In practice, ML/AI is best where data is plentiful and business is volatile (fast-moving consumer goods, new product introductions, omni-channel retail, etc.).

Qualitative methods: When historical data is limited or trends are shifting (e.g. new products, emerging markets, sudden disruptions), qualitative techniques are used. These include the Delphi method (expert panels iteratively refine a forecast), market research (surveys, customer feedback), and sales-team judgments.

Strengths: incorporate human expertise and real-time insights (such as knowledge of a major promotion or supply hiccup) that data alone can’t capture.

Weaknesses: subjective and potentially biased; inconsistent if experts disagree. Use case: forecasting demand for an entirely new product or in a rapidly changing market. In modern practice, qualitative inputs are often blended with quantitative forecasts (e.g. through a sales and operations planning consensus process).

Impact of Better Forecasting

The business impact is enormous. Even a one-point increase in forecast accuracy can translate to massive dollar savings. The Institute of Business Forecasting (IBF) estimates that each 1% improvement in forecast accuracy can save a company on the order of $0.97–$3.5 million (depending on industry and scale). In tech/manufacturing firms, IBF figures suggest about $970K to $1.5M saved per 1% accuracy gain, whereas in large CPG companies it can be $1.43M to $3.5M per point. Put differently, moving from, say, 70% to 75% accuracy might yield $5–10M in extra profit, inventory reduction and higher service levels. The combination of industry surveys and these ROI benchmarks makes the case clear: adopting AI in demand planning leads to significantly better forecasts and major cost/benefit improvements.

AI Adoption in Supply Chain

AI usage in supply chains, especially for demand forecasting, has grown rapidly in recent years. Surveys indicate roughly half of companies now leverage AI or machine learning for forecasting and planning. For example, a Gartner study found about 40% of the high performers surveyed said that they are using AI/ML for demand forecasting, while that figure came in at just 19% for the lower performers..

According to Deposco in their 2025 AI in Supply Chain report, AI is delivering measurable impact in demand forecasting by transforming complex data into precise, actionable insights that reduce inventory levels by up to 30% and improve product allocation across distribution centers. While only 26% of respondents currently cite demand forecasting as a primary AI use case, the report highlights its untapped potential—especially when integrated into unified platforms that align planning, intelligence, and execution for optimal forecast accuracy and responsiveness.

The COVID-19 crisis gave a major boost to AI and analytics adoption in supply chains. Supply‑chain disruptions highlighted the limits of legacy planning tools, and McKinsey and other analysts report a wave of digital investments from 2020 onward. In fact, McKinsey found that virtually all surveyed companies invested in new digital supply-chain technologies during the pandemic. Even industries initially hesitant (like automotive and commodities) ended up 100% committing to extra digital investment by 2021. The emphasis was on better planning and visibility: over 75% of companies prioritized upgrading their forecasting and planning systems, and many implemented new analytics platforms for demand sensing and inventory management.

Case Studies in Manufacturing

Kraft Heinz: Facing ongoing supply chain volatility and shifting consumer demand, Kraft Heinz set out to radically improve the precision of its demand forecasting efforts using artificial intelligence. The result has been a transformation not just in forecast accuracy, but in operational efficiency and sustainability. Since 2022, the company has achieved an 8% boost in monthly forecast accuracy and a 10% improvement at the weekly item-location level. These gains enabled smarter inventory allocation and led to a 25% reduction in excess inventory and a 10% drop in supply chain-related food waste. More importantly, service levels have improved, helping the company maintain product availability even during market disruptions.

Agribusiness (Food Manufacturing) with C3 AI: A large food/agribusiness customer of C3 AI converted a weekly forecasting process into a daily AI-driven forecast for 88 SKUs and multiple production lines. By processing 72 million rows of sales and operations data, the company improved forecast accuracy by about 8% and boosted gross margin by $30 million. This upgrade allowed far more responsive planning to volatile demand (seasonal produce) and translated into sizable bottom-line gains.

Church Brothers Farms (Produce/Agriculture): This major US vegetable grower used AI for demand-forecasting software to tackle highly seasonal, perishable demand. In implementation, short-term forecast accuracy jumped by up to 40% The AI model provided granular insights on product and customer level demand. The result was greatly reduced excess inventory and spoilage: Church Brothers reports “minimized excess stock and carrying costs” thanks to more precise planning. Better forecasts also improved order fulfillment rates and resource utilization across their 40,000 acres of crops.

Best Practices for Demand Forecasting Success

Cross-functional alignment: Ensure Sales, Marketing, Operations and Finance collaborate in forecasting. A formal S&OP/IBP process that aligns commercial promotions, production plans and financial targets is critical. In practice, best-in-class companies include key stakeholders (even customers/suppliers) in consensus forecasting to avoid silos.

Integrate external data: Enrich models with external signals such as market trends, competitor pricing, macro-economic indicators, weather patterns, and even social media or search trends. Leading companies incorporate these external datasets to capture demand drivers that internal history alone would miss.

Continuous planning cycle: Move away from static annual planning. Modern forecasting requires frequent re-forecasting (weekly or monthly) as new data arrives. Implement rolling horizon planning with regular review meetings and automated adjustments. This continuous cadence helps catch deviations early and keeps plans synchronized with reality.

Forecast value-add (FVA) analysis: Routinely measure how much each forecasting step (manual adjustments, consensus meetings, model changes) actually improves accuracy. FVA analysis identifies non-value-adding activities and biases, and encourages planners to rely on the strongest signals. Keeping only steps that demonstrably add accuracy helps prevent overfitting and wasted effort.

Executive support: Secure strong leadership buy-in and IT support. Executive sponsorship ensures investment in analytics tools and process discipline. Companies with C-level commitment to data-driven planning – and clear KPIs tied to forecast accuracy – achieve higher adoption and better outcomes. Leadership must champion a culture where forecast trust is built through transparency and results.

References:

Institute of Business Planning and Forecasts - Why Do Businesses Need Forecasts?, February 2025: https://ibf.org/knowledge/posts/why-forecasting-8

o9 - Why Kraft Heinz Demand Forecast Is at an All Time High, March 2025: https://o9solutions.com/articles/kraft-heinzs-demand-forecast-accuracy/

C3 AI - Enterprise AI for Demand Forecasting and Production Scheduling: https://c3.ai/customers/enterprise-ai-for-demand-planning-and-production-scheduling/

Gartner - Supply Chain Executive Report: Future of Supply Chain 2024, January 2024: https://www.gartner.com/en/documents/5156931

Deposco - 2025 AI in Supply Chain Report: https://deposco.com/ai-supply-chain-report/

McKinsey & Company - How COVID-19 is reshaping supply chains, November 2021: https://www.mckinsey.com/capabilities/operations/our-insights/how-covid-19-is-reshaping-supply-chains

Throughput - How AI-led Demand Forecasting Helped Church Brothers Farms Optimize Order Fulfillment, August 2024: https://throughput.world/blog/case-study-ai-demand-forecasting-for-agriculture-business