AI Maturity in 2025

The AI Maturity Sprint: 2025 in View

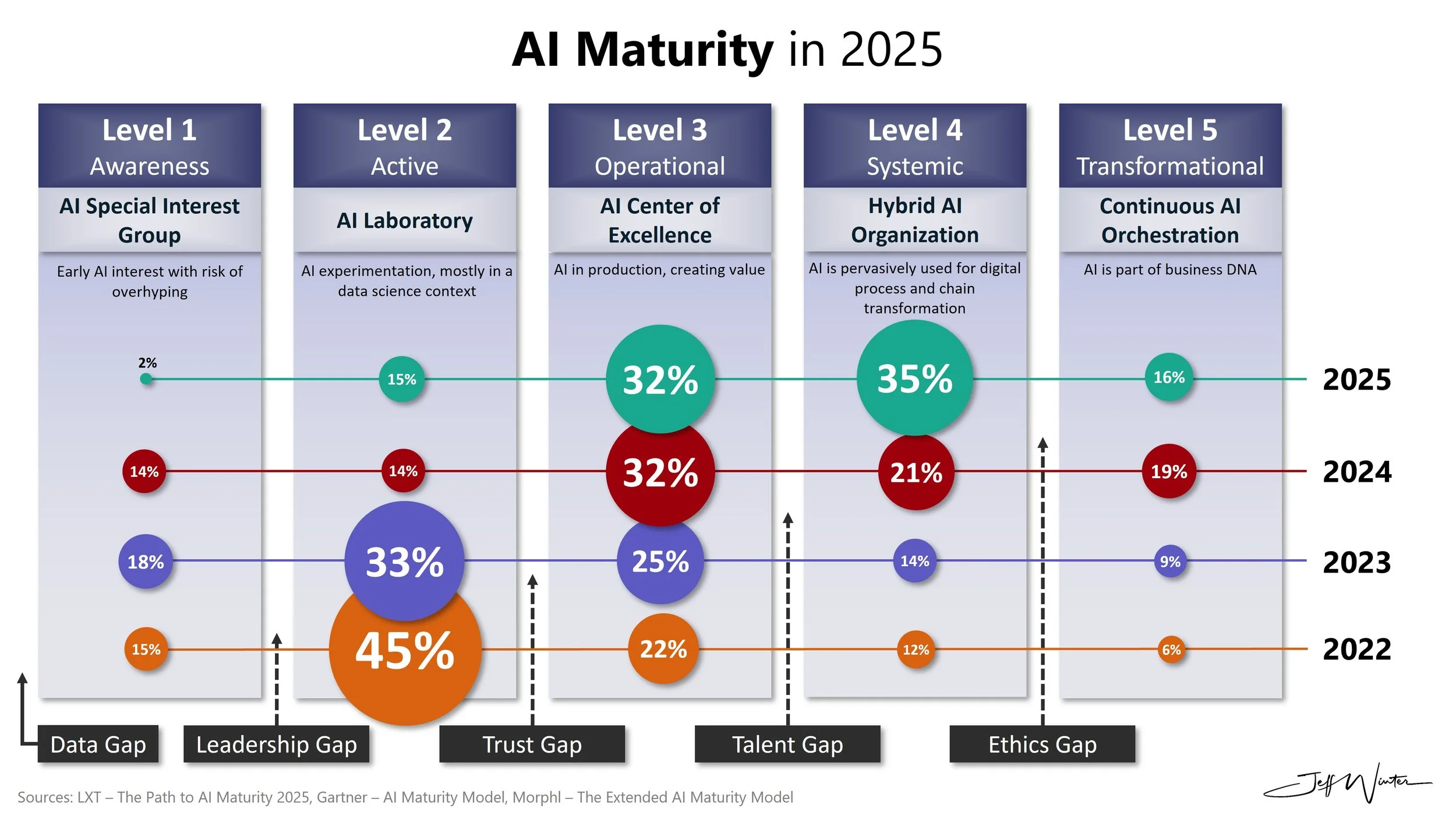

The AI race is well underway and by 2025 most companies have either left the station or are still tying their shoelaces. According to LXT’s Path to AI Maturity 2025 survey of mid-to-large U.S. organizations, enterprise AI is no longer a pilot project – it’s pervasive. In just four years the share of companies deemed “mature” (Operational stage or beyond) has more than doubled to 83%. Only about one in six firms (17%) are still in the experimental sandbox for traditional AI. Generative AI is even hotter: 75% of firms report gen AI at an operational or systemic level (driving real value) and 19% say gen AI is already woven into their business DNA (Transformational level). In short, most boards now have at least one true AI use case underway – and the buzzword is no longer “pilot,” it’s “productivity.”

Notably, Gen AI has vaulted to the top ROI slot. LXT finds that 65% of executives cite generative AI as delivering the highest return on investment, leapfrogging predictive analytics (45%) which used to reign supreme. Traditional staples like predictive analytics and conversational bots still show up in the applications list, but Gen AI (content generation, summarization, code-writing, etc.) is driving the most excitement. AI is no longer just a cost-cutter in 2025; it’s a growth engine. Executives now rank technological innovation (70%) and competitive advantage (66%) as their top AI strategy drivers, with traditional “risk management” dropping to seventh place. In short, AI is seen less as a checkbox for efficiency and more as a multipurpose performance booster.

That said, the journey isn’t all smooth sailing. LXT still finds 2 in 5 AI projects fail to meet goals. That’s down from 46% a few years ago to 39% now, but it’s a reminder that maturity doesn’t guarantee success. Mature organizations do significantly better (only ~29% of projects fail in top-tier firms vs ~43% for novices). The big difference-maker? Data. A whopping 80% of companies say high-quality, accurate training data is their top need, and 94% expect data needs to increase. In short, success = good data + mature processes. Skimp on either, and you’re asking your shiny new AI to perform a miracle.

How LXT Matches Up: Other Reports Weigh In

LXT’s findings fit the broad trendlines of recent industry studies, but with a few quirks. McKinsey’s State of AI 2025 report similarly finds widespread adoption – about 78% of surveyed companies report using AI, and 71% are deploying generative AI. (In other words, McKinsey sees Gen AI slightly less ubiquitous than LXT.) McKinsey highlights that large enterprises are leading the charge, reorganizing workflows and staffing up AI talent – a pattern LXT also implies by noting a surge in big-ticket investments (7× more companies now invest $500M+ in AI than last year). Both LXT and McKinsey stress that governance and leadership involvement pay off. McKinsey notes that CEO-driven AI oversight correlates with stronger financial impact, while LXT shows that firms at higher maturity report significantly fewer failed projects. In short: the boss steering the ship (and insisting on KPIs) beats leaving AI to chance.

However, there’s a surprising wrinkle in the ServiceNow Enterprise AI Maturity Index 2025 Report. Despite the enthusiasm, ServiceNow’s survey actually finds average AI maturity scores falling year-over-year. Fewer than 1% of companies even crack the midway point on their 100-point maturity scale. In plain English: many firms talk a big AI game but still lack the strategy and metrics to execute at scale. ServiceNow observes a “vision gap” – lots of experimentation but too few companies have clear goals, governance, or ROI measurement. This echoes McKinsey’s red flag that less than one-third of companies rigorously track AI performance or KPIs. In practice, it means you can have pilots of generative chatbots and vision systems, but without integration into workflows and budget planning, those projects remain skunkworks. (ServiceNow does note, however, that forward-looking “Pacesetter” firms – roughly the top 18% – are pulling away with strong margins and integrated AI platforms.)

Belief Without Execution: Manufacturing’s AI Reality Check

If enterprise AI is accelerating, manufacturing is still cautiously gearing up. According to the Amper 2025 AI in Manufacturing Report, 100% of manufacturing leaders say AI is important—a rare moment of total consensus. Yet just 8.2% have reached the scaling stage, and a striking 35% haven’t implemented any AI at all. The vision is there, but execution hasn’t caught up.

The disconnect deepens when you dig into readiness. 65% of companies believe AI can reduce human error, and 63% say it can accelerate industry progress. Yet only 41% trust AI to make critical decisions, and a mere 6% say their employees are prepared to use AI tools like copilots or agents . Even more telling, most expect less than 10% of their workforce will need AI training over the next three years—a clear underestimation of AI’s transformational impact .

Financial support isn’t keeping pace with strategic ambition either. Nearly half of manufacturers in the Amper study have no defined budget for AI, and only 8.2% dedicate more than 5% of their total spending to AI initiatives . Compared to enterprise tech sectors pouring hundreds of millions into AI annually (as highlighted by the LXT and McKinsey reports), manufacturing’s cautious funding stance puts it at risk of falling further behind.

The Tipping Point: Practical Use Cases, But Structural Gaps

The Manufacturing Leadership Council’s (MLC) 2025 Shaping the AI-Powered Factory of the Future Report echoes this emerging traction: over 70% of manufacturers have implemented AI-enabled vision systems, and 45% are using machine learning, most commonly for quality inspection and continuous improvement . Yet despite these footholds, scaling remains elusive.

MLC finds that only 18% of manufacturers have a formal AI strategy, with another 43% “working on one.” Just as critical, 65% cite poor data quality and accessibility as their number-one barrier to AI success . The same themes—strategy, data, and accountability—mirror what the LXT and McKinsey enterprise studies report for broader industry AI efforts, showing that foundational enablers remain stubbornly elusive even where pilots show promise.

And yet, according to Amper, manufacturing may actually be better suited for AI than many industries: its structured data, repeatable processes, and trackable KPIs align well with AI’s strengths . But that’s also the paradox. The rigidity of legacy infrastructure, underinvestment, and cultural resistance slow down what could be a high-velocity transformation.

Still, the urgency is rising. As Amper points out, macro trends like reshoring, labor shortages, and supply chain instability are forcing manufacturers to rethink how they operate. Those that prioritize AI now—by allocating budgets, building formal strategies, and training their workforce—will establish the next frontier of competitiveness. Everyone else risks watching from the sidelines as the future of intelligent operations passes them by.

Common Pitfalls

Data Neglect:

You can't fix bad inputs with a better algorithm. AI needs fuel—and that fuel is clean, contextual, domain-specific data. It's not just about having a lot of data; it's about having the right data. If you're pulling from messy spreadsheets, unlabeled machine logs, or five versions of the truth, you're setting yourself up to automate errors at scale.Pilot Paralysis:

You launched a chatbot. Great. Now what? If there's no clear path to scale, no business KPI being tracked, and no owner accountable for outcomes, that pilot is just a science fair project. AI only matters when it moves the needle, not when it lives in a demo.Governance Overlooked:

It’s easy to get swept up in the excitement of AI and skip over the uncomfortable stuff—like who’s responsible when a decision goes wrong. But without defined governance—clear ownership, version control, model drift monitoring, risk mitigation—you’re not innovating, you're gambling. Especially in regulated industries or mission-critical environments, skipping this step can become the most expensive shortcut you ever take.Skills Shortfall:

This one is sneaky. Everyone assumes once the tech is in place, the hard part is over—but that’s when the real gap shows up. Data scientists don’t know the machines. Operators don’t trust the dashboards. Engineers are stuck translating between the two. Without an intentional plan to bridge those gaps, you’re left with powerful tools sitting idle or misused.Lone Ranger Projects:

There’s a tendency to throw money at trendy Gen AI tools—like chatbots or digital assistants—without fixing underlying operational issues. It’s the equivalent of buying a smart mirror while your plumbing leaks. Flashy doesn’t equal value.

Best Practices

C-Suite Sponsorship:

AI needs more than budget—it needs belief. When the executive team champions AI as a strategic priority, it gets the visibility, resources, and accountability required for real impact. Without C-suite buy-in, even the best use cases stall in limbo.Data-First Mindset:

AI doesn't start with AI—it starts with data. Clean, labeled, contextualized, and compliant data is what turns algorithms into assets. That means involving the people who actually understand the processes: operators, engineers, and domain experts. Too often, companies skip straight to tools and vendors, thinking they can fix poor inputs with better tech. Spoiler: they can’t. Start by cleaning what you’ve already got. Prioritize data quality as a strategic initiative, not a backend chore. Good AI is just good data—on autopilot.Governance and Ethics:

AI without governance is like driving a car with no brakes—exciting until something goes wrong. And in manufacturing, “wrong” can mean product recalls, compliance violations, or safety incidents. Governance isn’t a checkbox—it’s the framework that defines who owns each model, who maintains it, how updates happen, and what to do if things go off track. It also means making ethics practical: setting boundaries for use cases, addressing bias in training data, ensuring traceability, and aligning AI with existing risk management. This isn’t just legal’s job—it’s a team sport involving IT, OT, ops, and leadership. And it shouldn’t be built after deployment. Put the guardrails in before the car hits the road. Otherwise, innovation turns into liability. Responsible AI isn’t slower AI—it’s sustainable AI.Pilot-to-Scale Discipline:

A successful AI journey isn’t about dabbling in 10 pilots—it’s about scaling one that works. Pick a use case with measurable value, track real KPIs, and prove the impact. Then use that success to build credibility and unlock budget. Scale isn't automatic; it's earned. And it requires intentional design, documentation, and repeatability—not just excitement.Talent & Training:

AI works when people do. Operators must trust it. Engineers must tune it. Data scientists must understand context. Training isn’t just technical—it’s cultural. Empower teams with role-specific skills and involve them early. Adoption happens when people feel equipped, not replaced.Integrate IT and OT:

For AI to deliver value in manufacturing, it must straddle two traditionally siloed worlds: IT (information systems) and OT (operational control). IT houses the data—MES, ERP, analytics. OT owns the action—PLCs, robotics, SCADA. If they don’t talk, AI can’t act. That’s the core issue. Predictive models that spot machine failure are worthless if they can’t alert the line or trigger a shutdown. Demand forecasting tools can’t drive inventory adjustments if the warehouse system is out of sync. The key is shared architecture and bi-directional communication. Build data models that bridge sensor data and enterprise insight. Create interoperability layers that translate across systems. And most of all—align teams. Engineers, IT architects, operators, and analysts must be in the same conversations. IT/OT convergence isn’t just a buzzword—it’s the infrastructure that turns AI from insight into impact. Ignore it, and you’re just making smarter dashboards. Embrace it, and you’re enabling smart manufacturing.Measure and Iterate:

If you're not measuring it, you're guessing. Set KPIs before you deploy. Track ROI, adoption, and business impact—not just model accuracy. If it’s not working, don’t double down—adjust. AI isn’t “set it and forget it.” It’s test, learn, improve, repeat.

Bottom line? The industry knows what AI can do. The leaders who act now—by allocating budget, upskilling their workforce, and integrating AI into the core of operations—will outpace their hesitant peers. Everyone else risks being left behind as digital transformation shifts from an edge to an expectation.

References

LXT - Path to AI Maturity 2025: https://www.lxt.ai/path-ai-maturity/

Gartner - The CIO’s Guide to Artificial Intelligence 2019: https://www.gartner.com/smarterwithgartner/the-cios-guide-to-artificial-intelligence

McKinsey & Company - The state of AI: How organizations are rewiring to capture value, March 2025: https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

Amper - 2025 Report: The State of AI in Manufacturing: https://www.amper.co/ai-in-manufacturing-report

Manufacturing Leadership Council - Shaping the AI-Powered Factory of the Future Survey Report 2025: https://manufacturingleadershipcouncil.com/future-of-manufacturing-project/shaping-the-ai-powered-factory-of-the-future/